Trends in advanced biofuels and hydrogen: where are we heading?

The European Green Deal and the Renewable Fuel Standard in North America have set up significant new standards for refinery emissions. All the while, new feedstocks are emerging, and technologies are being increasingly improved. Are we on the verge of the ultimate breakthrough for advanced biofuels and hydrogen in refineries and biorefineries?

Though the future is hard to predict, we see some tangible moves towards achieving lower GHG emissions. Recent developments in the legislative sphere are not to be ignored though the goals and means differ from region to region.

The European Green Deal…

This initiative is all about transforming the EU’s economy for a sustainable future. It is a growth strategy that aims to change the EU and ensure a resource-efficient economy, with one of the elements being a no-net emission of greenhouse gasses in 2050. Here explained by the European Commission:

“Further decarbonizing the energy system is critical to reach climate objectives in 2030 and 2050. The production and use of energy across economic sectors account for more than 75% of the EU’s greenhouse gas emissions. Energy efficiency must be prioritized. A power sector must be developed that is based largely on renewable sources, complemented by the rapid phasing out of coal and decarbonizing gas” (1)

(1) https://ec.europa.eu/info/sites/default/files/european-green-deal-communication_en.pdf.

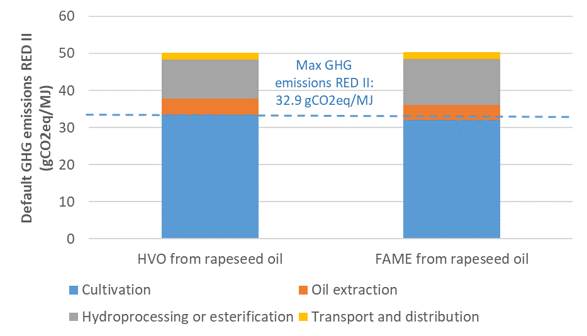

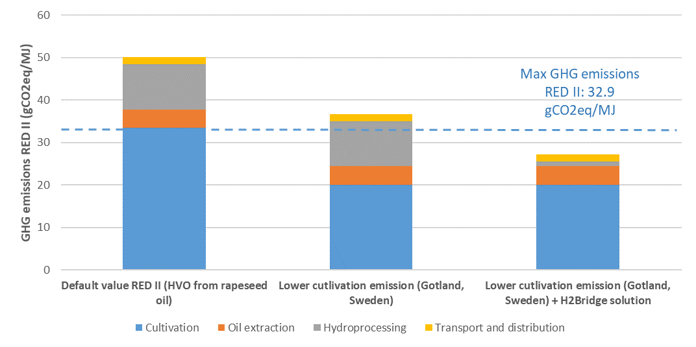

Also, the Renewable Energy Directive from 2018 (RED II) sets the target for consumption of renewables to 32%. This includes the transport sector, which for the road and train requires a minimum of 14% of the energy consumed by 2030 as renewable energy. The 14% target is also the minimum for eligibility for financial support from public authorities. In particular, the RED II introduces sustainability for forestry feedstocks and GHG criteria for solid and gaseous biomass fuels.

| Greenhouse gas savings thresholds in RED II |

Plant operation

start date |

Transport biofuels |

Transport

renewable fuels of

non-biological origin |

| Before October 2015 |

50% |

- |

| After October 2015 |

60% |

- |

| After January 2021 |

65% |

70% |

| After January 2026 |

65% |

70% |

National renewable action plans are being implemented to meet the targets and progress is measured every two years. (2)

(2) https://ec.europa.eu/jrc/en/jec/renewable-energy-recast-2030-red-ii

The cap on blending limits will be the game-changer

Biofuels produced from feedstocks with "high indirect land-use change-risk" (ILUC risk) are limited by a restrictive cap of at least 10% for fuels for transportation. From 31 December 2023 until 31 December 2030, at the latest, the limit shall gradually decrease to 0%.

Few countries offer 100% renewable fuel as an option for transportation. In most countries, it is a matter of blending. As the blending limits for FAME do not seem to be rising, both biorefineries and countries must look for alternatives to meet the targets set by the European Commission.

The answer is not surprisingly renewable diesel and renewable jet fuel with no caps.

The transport sector is leading the way in the US

In the US, there is a growing interest in renewable fuels. The RFS2 (Renewable Fuel Standard 2) requires refineries to blend 36 billion gallons of renewable fuel into the country's total transportation fuel consumption by 2022. At the forefront are states like California, Oregon, and Washington, with the Low Carbon Fuel Standard (LCFS) designed to decrease the carbon intensity of transportation fuel and provide an increasing range of low-carbon and renewable alternatives. New York is also aiming for a net-zero emission by 2050.

Despite oil prices dropping significantly, the renewable volume obligation still stands. Some companies are building new renewable diesel plants to meet future demand for renewable diesel. One driver for the transition is the authorities' economic incentives and tax deductions for refineries producing a certain number of barrels of renewable fuel. And with more states looking to adopt the LCFS protocol, the US market for renewable diesel and jet fuel will continue its growth.

Another US trend is the increased focus on waste-to-fuel. The FAME process is not ideal for this due to the structure of the molecules, but hydroprocessing provides a versatile and manageable solution allowing refiners and biorefiners to produce renewable diesel and renewable jet fuel and benefit from the incentives.

South America has enormous potential

Some people say that South America can become the new Saudi Arabia when it comes to renewable fuel production. Simply because the amount of feedstock in the region is vast. The climate, the growth rate of feedstocks, the bio-economy, the option to grow winter crops like brassica carinata or canola does not replace feed crops but allows countries to deploy the resources available to produce renewable diesel and renewable jet fuel.

The regions use of renewable jet fuel will most likely soar in the coming years when the aviation industry gets back on its feet. Legislations regarding renewable jet fuel seem to be on their way, and the easy access to feedstock makes the production relatively straightforward and economical.

South East Asia will most likely produce for local markets

The interest for renewable fuels is increasing in the region and feedstocks are plenty. Waste oils can be used to fill the increasing need for sustainable aviation fuel and several countries are looking towards renewable fuels to meet the Sustainable Development Goals. Combined with an increasingly growing plastic industry, this sets the scene for an off-take of high-value naphtha for plastic production.

Conclusion

The regional trends together paint a picture of an emerging industry that will grow to meet the global demands for renewable fuels using a multitude of feedstocks. Each region will have its preferred feedstocks and regional demands, but the overall trend is the need for renewable jet fuel seconded by naphtha and diesel demand. The business case is ready – are you?